回測(引用外部 data)

線上連結¶

pip install FinMind

初始化,設定回測股票代碼、時間區間

import numpy as np

import pandas as pd

from FinMind import strategies

from FinMind.data import DataLoader

from FinMind.strategies.base import Strategy

from ta.momentum import StochasticOscillator

data_loader = DataLoader()

# data_loader.login(user_id, password) # 可選

obj = strategies.BackTest(

stock_id="0056",

start_date="2018-01-01",

end_date="2019-01-01",

trader_fund=500000.0,

fee=0.001425,

data_loader=data_loader,

)

obj.stock_price

將會用以下 data 計算回測

date stock_id Trading_Volume Trading_money open max min close spread Trading_turnover CashEarningsDistribution StockEarningsDistribution

0 2018-01-02 2330 18055269 4188555408 231.5 232.5 231.0 232.5 3.0 9954.0 0.0 0.0

1 2018-01-03 2330 31706091 7504382512 236.0 238.0 235.5 237.0 4.5 13633.0 0.0 0.0

2 2018-01-04 2330 29179613 6963192636 240.0 240.0 236.5 239.5 2.5 10953.0 0.0 0.0

3 2018-01-05 2330 23721255 5681934695 240.0 240.0 238.0 240.0 0.5 8659.0 0.0 0.0

4 2018-01-08 2330 21846692 5281823362 242.0 242.5 240.5 242.0 2.0 10251.0 0.0 0.0

.. ... ... ... ... ... ... ... ... ... ... ... ...

729 2020-12-25 2330 12581145 6449612552 514.0 515.0 510.0 511.0 1.0 14988.0 0.0 0.0

730 2020-12-28 2330 19262886 9890545245 512.0 515.0 509.0 515.0 4.0 16673.0 0.0 0.0

731 2020-12-29 2330 20151736 10370562545 515.0 517.0 513.0 515.0 0.0 17186.0 0.0 0.0

732 2020-12-30 2330 46705107 24306881615 516.0 525.0 514.0 525.0 10.0 33173.0 0.0 0.0

733 2020-12-31 2330 30326332 15989936054 526.0 530.0 524.0 530.0 5.0 25134.0 0.0 0.0

設計策略

class ShortSaleMarginPurchaseRatio(Strategy):

"""

summary:

策略概念: 券資比越高代表散戶看空,法人買超股票會上漲,這時候賣可以跟大部分散戶進行相反的操作,反之亦然

策略規則: 券資比>=30% 且法人買超股票, 賣

券資比<30% 且法人賣超股票 買

"""

ShortSaleMarginPurchaseTodayRatioThreshold = 0.3

def load_taiwan_stock_margin_purchase_short_sale(self):

self.TaiwanStockMarginPurchaseShortSale = (

self.data_loader.taiwan_stock_margin_purchase_short_sale(

stock_id=self.stock_id,

start_date=self.start_date,

end_date=self.end_date,

)

)

self.TaiwanStockMarginPurchaseShortSale[

["ShortSaleTodayBalance", "MarginPurchaseTodayBalance"]

] = self.TaiwanStockMarginPurchaseShortSale[

["ShortSaleTodayBalance", "MarginPurchaseTodayBalance"]

].astype(

int

)

self.TaiwanStockMarginPurchaseShortSale[

"ShortSaleMarginPurchaseTodayRatio"

] = (

self.TaiwanStockMarginPurchaseShortSale["ShortSaleTodayBalance"]

/ self.TaiwanStockMarginPurchaseShortSale[

"MarginPurchaseTodayBalance"

]

)

def load_institutional_investors_buy_sell(self):

self.InstitutionalInvestorsBuySell = (

self.data_loader.taiwan_stock_institutional_investors(

stock_id=self.stock_id,

start_date=self.start_date,

end_date=self.end_date,

)

)

self.InstitutionalInvestorsBuySell[["sell", "buy"]] = (

self.InstitutionalInvestorsBuySell[["sell", "buy"]]

.fillna(0)

.astype(int)

)

self.InstitutionalInvestorsBuySell = (

self.InstitutionalInvestorsBuySell.groupby(

["date", "stock_id"], as_index=False

).agg({"buy": np.sum, "sell": np.sum})

)

self.InstitutionalInvestorsBuySell["diff"] = (

self.InstitutionalInvestorsBuySell["buy"]

- self.InstitutionalInvestorsBuySell["sell"]

)

def create_trade_sign(self, stock_price: pd.DataFrame) -> pd.DataFrame:

stock_price = stock_price.sort_values("date")

self.load_taiwan_stock_margin_purchase_short_sale()

self.load_institutional_investors_buy_sell()

stock_price = pd.merge(

stock_price,

self.InstitutionalInvestorsBuySell[["stock_id", "date", "diff"]],

on=["stock_id", "date"],

how="left",

).fillna(0)

stock_price = pd.merge(

stock_price,

self.TaiwanStockMarginPurchaseShortSale[

["stock_id", "date", "ShortSaleMarginPurchaseTodayRatio"]

],

on=["stock_id", "date"],

how="left",

).fillna(0)

stock_price.index = range(len(stock_price))

stock_price["signal"] = 0

sell_mask = (

stock_price["ShortSaleMarginPurchaseTodayRatio"]

>= self.ShortSaleMarginPurchaseTodayRatioThreshold

) & (stock_price["diff"] > 0)

stock_price.loc[sell_mask, "signal"] = -1

buy_mask = (

stock_price["ShortSaleMarginPurchaseTodayRatio"]

< self.ShortSaleMarginPurchaseTodayRatioThreshold

) & (stock_price["diff"] < 0)

stock_price.loc[buy_mask, "signal"] = 1

return stock_price

回測模擬交易

obj.add_strategy(ShortSaleMarginPurchaseRatio)

obj.simulate()

obj.final_stats

output

MeanProfit 187013.454352

MaxLoss -17592.160000

FinalProfit 716596.810000

MeanProfitPer 37.400000

FinalProfitPer 143.320000

MaxLossPer -3.520000

AnnualReturnPer 34.500000

AnnualSharpRatio 1.430000

dtype: float64

交易明細

obj.trade_detail

output

stock_id date EverytimeProfit RealizedProfit UnrealizedProfit board_lot hold_cost hold_volume signal tax fee trade_price trader_fund

0 2330 2018-01-03 0.00 0.00 0.00 1000 0.0000 0 0 0.003 0.001425 236.0 500000.000

1 2330 2018-01-04 0.00 0.00 0.00 1000 0.0000 0 0 0.003 0.001425 240.0 500000.000

2 2330 2018-01-05 0.00 0.00 0.00 1000 0.0000 0 0 0.003 0.001425 240.0 500000.000

3 2330 2018-01-08 0.00 0.00 0.00 1000 0.0000 0 -1 0.003 0.001425 242.0 500000.000

4 2330 2018-01-09 0.00 0.00 0.00 1000 0.0000 0 -1 0.003 0.001425 242.0 500000.000

.. ... ... ... ... ... ... ... ... ... ... ... ... ...

728 2330 2020-12-25 692703.01 160992.91 531710.10 1000 245.8705 2000 0 0.003 0.001425 514.0 47251.925

729 2330 2020-12-28 688720.71 160992.91 527727.80 1000 245.8705 2000 0 0.003 0.001425 512.0 47251.925

730 2330 2020-12-29 694694.16 160992.91 533701.25 1000 245.8705 2000 0 0.003 0.001425 515.0 47251.925

731 2330 2020-12-30 696685.31 160992.91 535692.40 1000 245.8705 2000 0 0.003 0.001425 516.0 47251.925

732 2330 2020-12-31 716596.81 160992.91 555603.90 1000 245.8705 2000 0 0.003 0.001425 526.0 47251.925

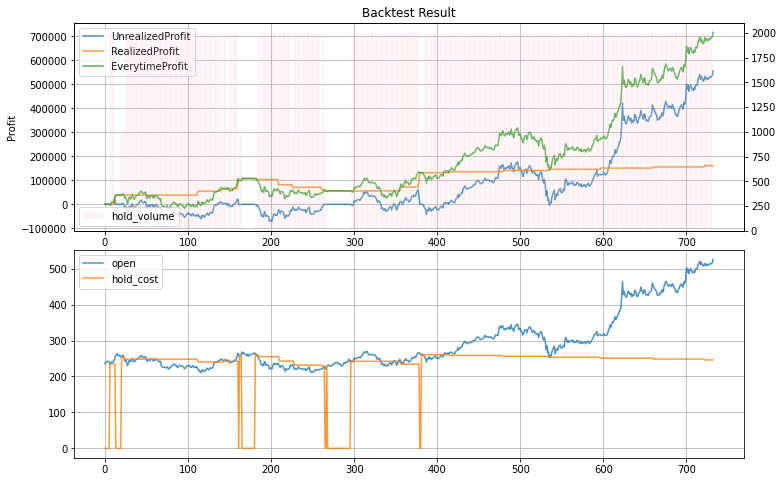

視覺化

obj.plot()